Blog

Chinese Government Promotes Digital Upgrade of Tax Collection Through Expansion of Fully-Digitalised E-Fapiao

A fapiao – otherwise known as a tax invoice – is an official document issued by the State Taxation Administration (STA) of China. To combat tax evasion and ensure compliance with trade laws, businesses must record all transactions on the fapiao. In a past blog article, we explained why fapiaos are so important in doing business in China. Without it, a company may not be able to deduct the associated expense for tax purposes and an individual may not be able to reclaim business expenses. However, movements were severely restricted due to surges in COVID-19 cases in China and, as a result, businesses find it extremely challenging to issue physical fapiaos. As a result, the digital e-fapiao programme has been expanded to allow more cities within China to participate.

Digital E-fapiao Explained

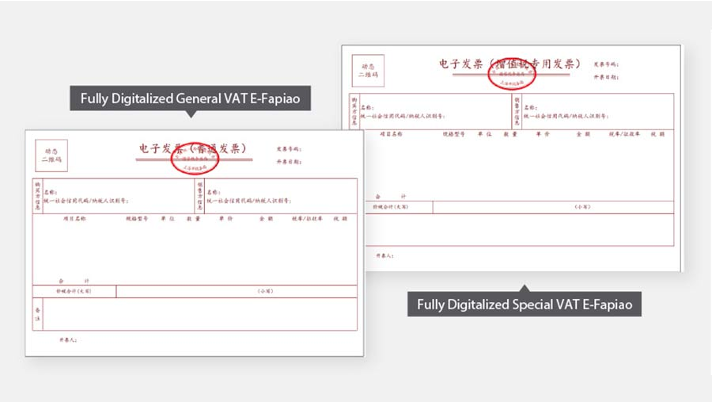

There are two types of fully-digitalised e-fapiao in China: special VAT e-fapiao and general VAT e-fapiao. Both have the same legal effect as the paper fapiao and the normal e-fapiao.

Under the fully-digitalised e-fapiao programme, a national unified e-invoicing service platform will provide pilot taxpayers 24-hour online services to issue, deliver and verify fully-digitalised e-fapiaos free of charge. This means that special tax control equipment, such as golden tax USB disk, tax control USB disk, and tax UKey, are no longer needed.

The pilot programme of the fully-digitalised e-fapiao was first introduced on 1 December 2021, when selected taxpayers in Shanghai, Guangdong (Guangzhou, Foshan, Guangdong-Macao Intensive Cooperation Zone), and Inner Mongolia (Hohhot) started to issue and accept fully-digitalised e-fapiaos. The pilot programme was expanded in 2022 with more taxpayers being able to issue and accept fully-digitalised e-fapiaos. They will also look neater, with only 17 items of content: dynamic QR code, invoice number, issuance date, buyer information, seller information, project name, specification and model, unit, quantity, unit price, amount, tax rate/levy rate, tax amount, total, ad valorem and tax total (in words and figures), remarks and invoice.

Please refer to a sample of the fully-digitalised e-fapiao below:

The STA has established a nationwide online platform to enable pilot taxpayers to issue, deliver, and validate the fully-digitalised e-fapiao with no charge. The implementation marks the latest effort by the Chinese government to promote the digital upgrade and intelligent transformation of tax collection and administration, thereby reducing tax costs. This could bring far-reaching changes to the daily operations of businesses and tax administration.

New Features of the Fully-Digitalised E-fapiao

The procedures to obtain and issue a fully-digitalised e-fapiao are much more straightforward:

- No special tax control equipment needed: Taxpayers under the pilot programme will not need to get special tax control equipment in advance to issue fapiaos; they can issue the fully-digitalised e-fapiao through the national e-invoicing service platform.

- Fuss-free and easy application: Taxpayers under the pilot programme will not need to obtain the fapiao through application to the tax bureaus; they can obtain them through the e-invoicing service platform, which will automatically assign a unique fapiao number.

- Individual assessments based on taxpayers’ credibility: The tax authorities will determine the initial maximum number of invoices issued by the taxpayer in a calendar month and adjust based on the risk level, taxpaying credit rating, actual operating conditions, and other factors of a taxpayer. The maximum invoice amount refers to the upper limit of the total invoice amount the pilot taxpayer’s invoice is issued within a month, excluding VAT. Different from the traditional paper fapiao, the fully-digitalised e-fapiao is not limited by the number of fapiaos issued or the maximum amount of a single fapiao.

Eventually, newly established taxpayers can issue a fully-digital e-fapiao as soon as they start the business without cumbersome procedures.

Benefits of the Fully-Digital E-fapiao

- Diversified channels for issuance of e-fapiaos: Pilot taxpayers can issue them through the unified e-invoicing service platform. In the near future, they may also be able to issue e-fapiao through a digital terminal or through a mobile app, eliminating the need for special tax control equipment.

- One-stop e-fapiao service platform: After logging onto the platform, pilot taxpayers can issue, deliver and verify fapiaos on one platform instead of completing related operations on multiple platforms.

- More widely applicable fapiao data: Pilot taxpayers’ tax digital accounts on the e-fapiao service platform will automatically collect invoice data for enquiry, downloading and printing. Once the fully-digitalised e-fapiao is issued, the fapiao information will automatically be sent to the tax digital accounts of both the issuer and the receiver for them to check and download. The issuers can track the invoice usage of the receiver in real time through the tax digital account (e.g. if the VAT has been deducted or not). Digitalised fapiao data will also lay a foundation for taxpayers to pre-fill the ‘single integrated form’ for tax declaration.

- No specific digital formats required: Unlike a normal VAT e-fapiao, which needs to be in PDF or OFD formats, a fully-digitalised e-fapiao is not required to be saved in a specific digital format. Pilot taxpayers can deliver them through their tax digital accounts on the e-invoicing service platform, or by email, QR code, or other means. This will reduce fapiao delivery costs and simplify the method for taxpayers to process fapiaos.

- Availability of multiple value-added tax services: The e-fapiao service platform will incorporate more interactive features, such as smart consulting and objection submission functions.

Fully-digitalised e-fapiaos are expected to greatly reduce the workload of companies’ financial and accounting staff and increase the efficiency of issuing a fapiao.

|

Fully-digitalised e-fapiao benefits:

|

However, companies may face short-term challenges regarding the processing and archiving of fully-digitalised e-fapiaos, as the corresponding financial processes need to be adjusted based on the new features of the fully-digitalised e-fapiao. Moreover, there is now a narrower margin of error as technology is utilised in processing these e-fapiaos. Companies are advised to conduct regular tax checks and internal controls to ensure everything is accurate.

Rely on Your Relocation Provider

The good news is that you do not have to do it on your own. Companies can look to their corporate relocation providers to help create an e-fapiao policy and implement measures to track and monitor the entire process. Fapiaos are a unique part of the expense management process in China and working with a relocation provider with local expertise in fapiao management reduces the burden and potential risk for both your organisation and your employees. It also helps to address an important and detailed process with very specific compliance requirements, to achieve the proper tax benefits for companies with impacted employees in China.

For more information, or for assistance with the creation of a fapiao policy and/or implementation measures please contact us at concierge@sirva.com.