Blog

Weighing up the Pros and Cons of Renting vs Buying in Today’s Market

Purchasing a home is a challenge right now for many transferring employees due to rising home prices and increased interest rates. At the same time, rent costs are also rising to record highs. Because of this, many transferees may struggle to find suitable, affordable housing in their new location. One question they will need to answer is, is it better to rent or buy in today’s market?

It’s important for HR and mobility managers to understand the role housing plays in their employees’ well-being and how they can support transferring employees since housing is a necessity, not a discretionary need. The ability to find acceptable housing will affect whether or not an employee accepts an offer to relocate. Let’s take a look at some of the factors affecting affordability, as well as some of the pros and cons of buying a home and renting.

Home Affordability Challenges

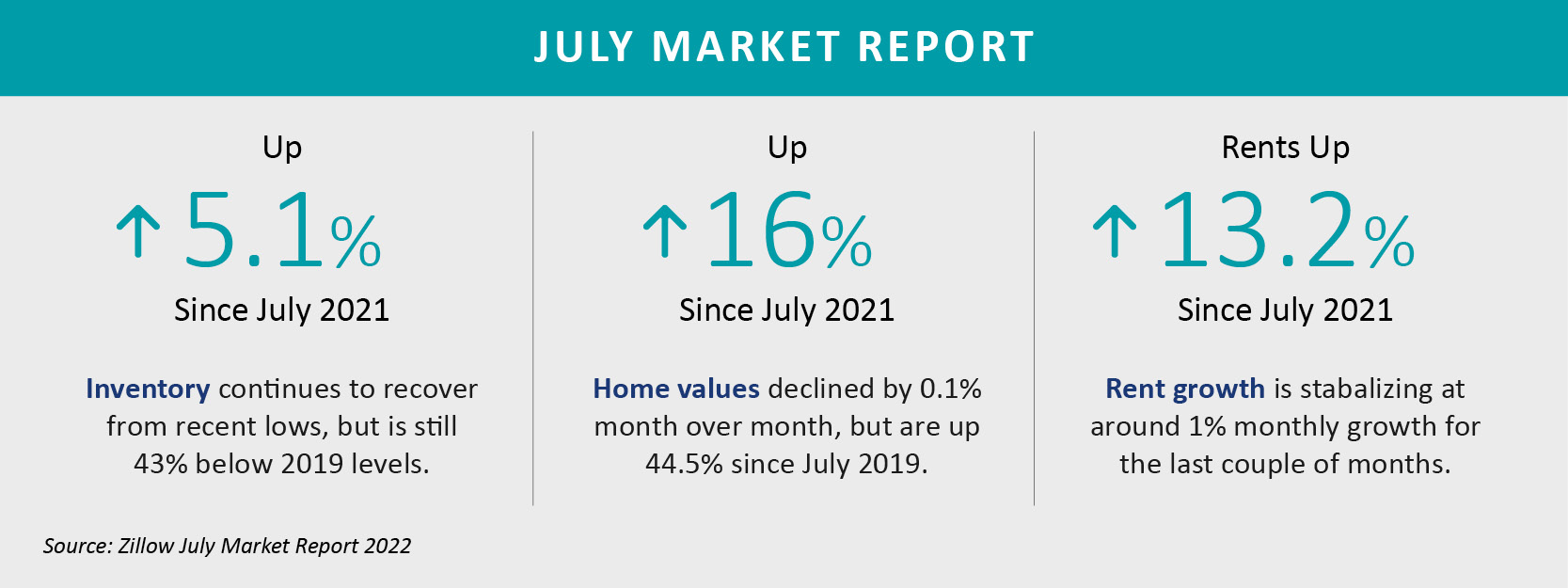

Affordability is still an issue for many would-be buyers. Purchasing a home today is about 40% more expensive than it was a year ago. According to Realtor.com, in June 2022 the median asking price reached a new high, US$416,000, and the number of active listings is still only half of what it was in May 2020. Inventory was up slightly in June, but still below the norm, and homes are remaining on the market for 14 days on average, around half the pre-pandemic days on market. So, it is a sellers’ market and there is a lot of competition for the few available homes.

Mortgage Rates Increased

Mortgage interest rates have also increased. In an effort to combat the impact of inflation, the US Federal Reserve has increased the federal funds rate three times this year and has announced plans for further increases in 2022. Fixed rates have increased by more than two full percentage points since the beginning of the year. With both purchase price and interest rates increasing, potential home buyers are paying much more for a home today.

Surging Rent Costs

Rents have continued to surge nationwide. The national median asking rents are 14% higher year over year in June and are averaging US$2,016 per month. Affordability struggles in the purchase market are forcing many potential buyers to stay in the rental market, setting new records for occupancy rates and pushing renters into bidding wars.

There are a number of factors that transferring employees should consider when making the decision to rent or buy, depending on their personal circumstances.

Advantages of Renting

- In some metropolitan areas with a healthy local economy and very low unemployment rates, renting a home is more appealing than buying one. In these areas homeownership may be more feasible, which takes some of the upward pressure from the rental market and makes renting relatively more affordable.

- Will the employee be relocating again in a couple of years? If so, then renting might be the better option and offer them more flexibility to move again in a year or two.

- Does the homebuyer have enough funds saved for a down payment? If not, they may want to consider renting temporarily until they have enough money saved to put down on a home.

- If an employee doesn’t want the responsibility of handling maintenance or repairs on a home, then they may prefer to rent. As a renter, maintenance is the landlord’s responsibility.

Disadvantages of Renting

- Rent payments are determined by the landlord and can increase over time.

- If an employee wants the freedom to remodel and decorate the home, it may not be a good fit as they may not have a lot of flexibility in customising their space.

- Renting does not build equity. Monthly payments build wealth for the landlord, not the renter.

Advantages of Buying

- In some areas, rising rents make buying more attractive, even with higher home prices and rising interest rates.

- If the employee plans on staying in the same home for more than a couple of years, then buying may offer the stability they are looking for.

- The monthly mortgage payment can remain stable with a fixed rate mortgage.

- Homeowners have the freedom to customise, decorate and remodel as they wish.

- If building equity and wealth is important to the transferring employee, then purchasing a home is the way to go.

Disadvantages of Buying

- Homeowners take on responsibility for regular maintenance and needed repairs. Sometimes these expenses can be unexpected and costly.

- Homeowners are responsible for paying property tax.

- Increased home prices and rising interest rates can make affording a home challenging for many potential buyers.

How Can You Support the Housing Needs of Your Employees?

There are several ways that HR and mobility managers can assist transferring employees with making the right housing decision for their circumstances.

- Work with the experts. Your relocation management provider will partner with experienced agents who can help transferring employees navigate the local housing market.

- Seek a preferred lender. If your employees intend to purchase, encourage them to work with a preferred lender who can help the employee get pre-approved early in the process.

- Work with destination service teams. Your relocation management provider will partner with expert destination service teams to assist with finding rental properties and help with lease negotiations.

Whatever the financing needs of your transferees may be, SIRVA Mortgage is here to help. With 30 years of focus and expertise in relocation mortgage lending, we understand the important role home financing plays in the relocation process. Please visit our mortgage website to learn more, or contact us, at MortgageClientServices@sirva.com.

SIRVA Mortgage, Inc. (NMLS Unique Identifier# 2240) is engaged in the business of originating residential mortgage loans. We are licensed or authorised to conduct mortgage loan origination in all 50 US states plus the District of Columbia. SIRVA Mortgage is not a depository institution and does not act as or represent itself a full-service bank. Reference to the term “mortgage banker” is a common, accepted industry term referring to companies engaged only in the business of making mortgage loans. Various state laws and regulations and our individual licence in various states refer to us as a mortgage lender, mortgage banker or mortgage broker. For our Privacy Policy and Affiliated business relationships please visit https://mortgage.sirva.com/about/about-sirva-mortgage. Call +1-800-531-3837 for more information. SIRVA Mortgage, Inc. is licensed by (amongst others): Arizona Licensed Mortgage Banker, Licence #BK-901430; Licensed by the Department Corporations under the California Residential Mortgage Lending Act, Lender Licence #413-0944; Georgia Residential Mortgage Licensee #6221; Illinois Residential Mortgage Licensee; Kansas Licensed Mortgage Company, Licence #SL.0000368; Massachusetts Mortgage Lender, Licence #ML1341; Licensed by the Mississippi Department of Banking and Consumer Finance, Mississippi Licensed Mortgage Company #369/2009; Missouri Residential Mortgage Licensee; Montana Mortgage Lender Licence #39706, Licensed by the New Hampshire Banking Department; Licensed by the New Jersey Department of Banking and Insurance; New York Licensed Mortgage Banker by the N.Y. State Banking Department; Ohio Mortgage Broker Licence #MB.803887.000; Licensed by the Pennsylvania Department of Banking; Rhode Island Licensed Lender; Texas Mortgage Lender, Licence #44605; Licensed as a Mortgage Lender by the Virginia State Corporation Commission, Licence #MC-310. This is not an offer of credit or an offer to enter an interest rate lock-in agreement nor is this notice of loan approval. Main Office of SIRVA Mortgage, Inc.; 6200 Oak Tree Blvd., Ste 300, Independence, OH 44131; Telephone: 1-800-531-3837.