Blog

What Are Fapiao And Why Do They Matter?

One of the more complex elements of relocation in China is a “fapiao.” In China, invoices (or "fapiao" in Chinese) are used by the government to monitor the tax paid on any transaction. Fapiao are printed, distributed, and administrated by tax authorities. The fapiao is effectively a receipt, created by the government to show proof of a tax payment. The importance of the fapiao is that, without proof of the tax payment, a company may not be able to deduct the associated expense for tax purposes and an individual may not be able to reclaim business expenses.

The Chinese government taxes different types of services at varying rates, depending on the location where those services are rendered. This is where a fapiao comes in. The most common fapiao types include those for rental properties, utilities, education, vehicles, medical, training, and shipping. For many products, including food, books, and clothing, customers pay the tax at the time of purchase and there is no need to pay an extra tax in the form of a fapiao.

Fapiao can be sorted into two main categories: general VAT (value-added tax) fapiao and special VAT fapiao. Although these terms are often used interchangeably as they are both called fapiao, there are notable differences between the two.

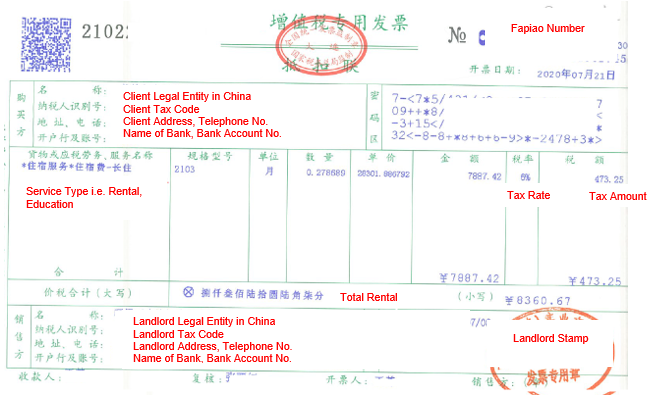

First, the special VAT fapiao can be used for tax deduction purposes, while the general VAT fapiao cannot. Second, as a special VAT fapiao is used for tax deduction purposes, it will contain many more details regarding the trader's information, including tax number, address, telephone number, and bank account information.

Organisations that are relocating employees to China should be aware of the common types of fapiao, how to obtain them, how to manage them, and how to comply with fapiao requirements to avoid any tax implications. Businesses should work with their internal finance controller to prepare a clear and detailed fapiao instructions document and be sure to share it with employees and vendors to ensure the fapiao can be issued correctly.

As an example, to illustrate how a fapiao works: A landlord and tenant sign a tenancy agreement (the tenant in this example is a corporate client). The client pays the landlord the rental fee; the landlord takes the tenancy agreement to the tax bureau; the tax bureau calculates the required tax based on the amount of the rental; the landlord pays the tax and receives a fapiao for a specified amount; the landlord presents the client with the fapiao; the client’s finance department then keeps the fapiao on file for bookkeeping and audit purposes.

Sample of a fapiao

Complying with Fapiao Requirements

The previous example might appear simple, but several things can happen to complicate compliance. For example, the party who receives the payment (i.e. the landlord) may not voluntarily provide the payer (i.e. the client) with the fapiao in a timely way or at all; ultimately, organisations should diligently follow up to ensure that fapiao is collected in a timely manner for tax reporting.

Additional challenges that could impede the proper issuance and use of a fapiao include a landlord issuing the wrong type of fapiao (for example a “services” fapiao instead of a “rental” fapiao) or the client not properly tracking, filing, and processing the fapiao, which could invite disputes. If these occur, it could result in the client’s finance department rejecting assignee expense claims, a denial of corporate deductions, or other tax liabilities.

To protect themselves from these challenges, companies should understand implementation and measures regarding how to comply with fapiao requirements and understand best practices to mitigate any associated risks. A supplier must provide a fapiao that meets a number of criteria to be compliant. The fapiao would have to be:

- Issued pursuant to government policy and finance regulations

- Relevant to the purchased services or goods (i.e. for lease purposes, the landlord should issue a fapiao under the “rental” category)

- Authentic (counterfeit documents are a risk in certain areas)

- Inclusive of all required information, and provided within a specified period of time

SIRVA recommends that clients document clear policies, processes, training, and delegated authorisations to their stakeholders and employees to prevent potential issues. For example, if the fapiao is provided by the landlord to the client via the assignee/transferee, the client should educate the employee on the fapiao and its process. Any uncertainty around when a fapiao is to be issued, where it is to be sent, or who is to receive and file the document can lead to confusion and potential penalties.

The most common and financially significant type of fapiao issued in a relocation is for housing rentals. To better insure fapiao compliance in tenancy arrangements, companies should develop agreements that address the following points:

- Who should issue the fapiao – Clients should not only determine who should issue the fapiao (i.e. the service provider of the client), but also who should receive and file the document for future tax purposes.

- When the fapiao should be issued – Clients should determine when the landlord is to issue the fapiao, including the number of days before or after the rental payment is due. Clients should also state that, in the event of a delay, the client has autonomy to issue the fapiao and pay the tax directly to the government and deduct the tax from the next month’s rent.

- Where the fapiao should be sent - Clients should determine where the fapiao is to be sent.

Rely on Your Relocation Provider

When it comes to fapiao, companies are not in it alone. Organisations can look to their corporate relocation providers to help create a fapiao policy and implement measures to track and monitor the fapiao issuance.

For example, in the case of a tenancy-agreement fapiao, a relocation provider with fapiao management capabilities can ensure that the landlord provides accurate, complete, and timely fapiao for the duration of the lease term. The relocation provider can also act as a back-up retention source for the completed fapiao should they be required later. Most importantly, a relocation provider can work with the client, every step of the way, to ensure that the landlord is following the process established in the tenancy agreement and assist or provide guidance when needed.

Fapiao are a unique part of the expense management process in China. Working with a relocation provider with local expertise in fapiao management reduces the burden and potential risk on both the client and the employee. It also helps to address an important and detailed process with very specific compliance requirements, so as to achieve the proper tax benefits for companies with impacted employees in China.

For more information, or for assistance with the creation of a fapiao policy and/or implementation measures please contact us at concierge@sirva.com.

Interested in the difference between E-Fapiao and physical Fapiao? Check out our blog, E-Fapiao: Are They Different from Paper Fapiao?

Contributors:

Jialin Chia, Marketing Manager, Asia and Middle East, SIRVA

Lisa Marie DeSanto, Content Marketing Manager

SIRVA provides information and guidance based upon its industry experience. However, SIRVA does not provide tax or legal advice or provide tax or legal opinions on which you can rely. You must contact your own counsel or tax advisor for tax or legal advice and opinions for your particular circumstance.

For more information please see SIRVA’s Blog Disclaimer.