Blog

Addressing Affordability Concerns in Today’s U.S. Real Estate Market

Home values continue to rise in the U.S., inventory remains at an all-time low, and mortgage interest rates are increasing at a pace we haven’t seen since the 1980s. Unfortunately, rising mortgage payments are eroding purchasing power for buyers and causing affordability concerns for many home buyers. Are your relocating employees struggling to afford purchasing their new home?

Home Values Continue to Skyrocket

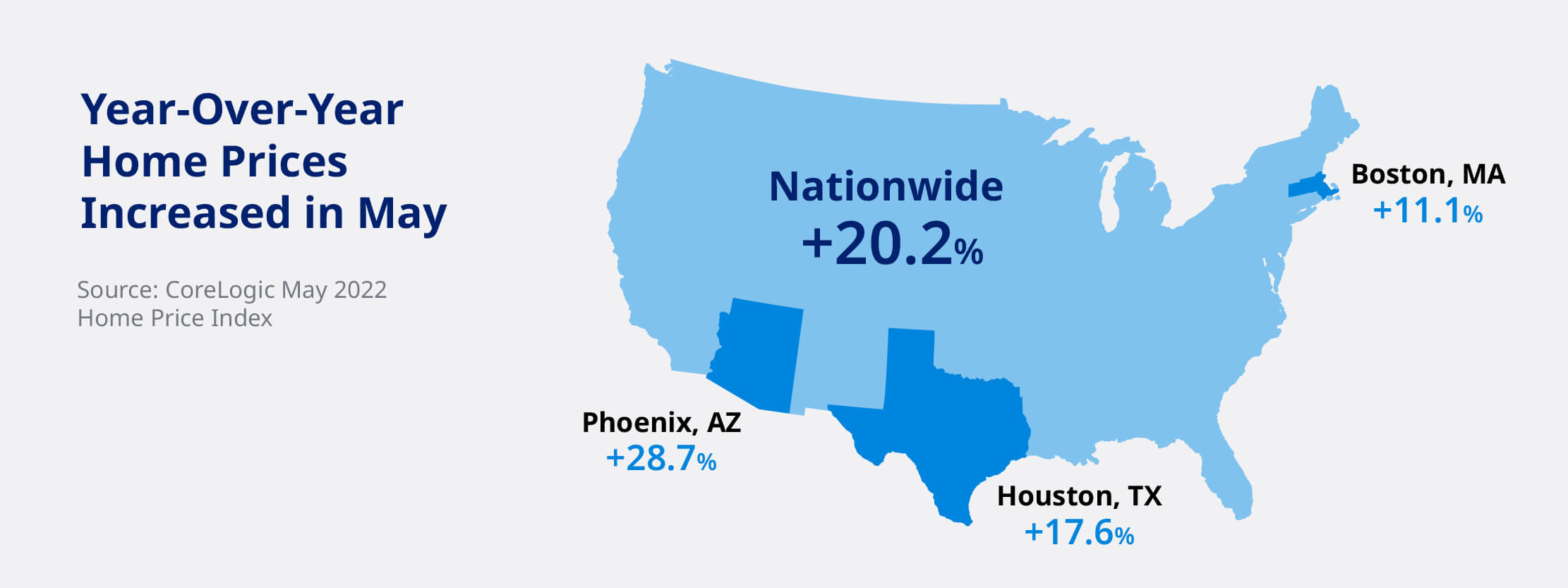

According to CoreLogic, year-over-year home prices increased nationwide by 20.2% in May. Many different factors have contributed to increased home prices, including:

|

Rising Home Prices

A few market examples from CoreLogic’s May Home Price Index show an increase year over year in:

Interest Rates on the Increase

After a stretch of historically low rates, home buyers are now challenged with rising interest rates. The interest rate on a 30-year fixed mortgage has increased two and a quarter percentage points from just one year ago, levels not seen since 2009. In an effort to combat the impact of inflation, the Federal Reserve has increased the federal funds rate three times this year and has announced plans for further increases in 2022.

With both purchase price and interest rates increasing, the scenario below illustrates that a buyer purchasing the same home 12 months ago would be paying just over $650 more in principal and interest payments today.

|

|

May 2021 |

May 2022 |

|

Purchase Price (with 20% down) |

$340,000 |

$408,600 |

|

30-year Fixed rate |

3.00% |

5.25% |

|

Principal & Interest Payment (per month) |

$1,147 |

$1,805 |

Adding to the challenge of affordability, income has not kept up with the increase in home values. Bloomberg reported in March that across all income levels, just 18% of consumers said that their wages were keeping pace with the higher cost of living. Costs associated for items needed once in a new home have also increased due to inflation such as window treatments, furniture, and lawn mowers. The consumer price index, a measure of prices for goods and services, accelerated 8.6% in May from a year ago and near the highest level in more than 40 years. (CNBC)

Rental Prices are also Climbing

Unfortunately, it is not just home prices that are rising. Rental prices are also rising steeply with Realtor.com indicating median rents in the 50 largest U.S. metro areas reaching an all-time high and rising 17% in the past year. A recent Zillow report found that a one-year lease would cost around $3,400 more than the same lease two years ago. The rapid rise in rental costs is leading more renters to explore their home ownership options. We will explore rental challenges in a future blog post.

How Organizations Can Assist Employees

Although affordability challenges aren’t expected to go away any time soon, CoreLogic is projecting annual home price gains to slow to 5.0% by next May. While rising interest rates and high home prices will continue to impact affordability for home buyers, there are a few approaches that employers can pursue to support their relocating employees in navigating this challenging market, including:

- Partner with experts. Experienced real estate agents who are familiar with local markets and relocation can help your employees find a home and submit a competitive offer.

- Plan ahead. Encourage your employees to get preapproved early so they have a solid understanding of their finances and what they can afford. A strong preapproval letter will also likely be required by the seller when submitting an offer.

- Provide additional support. Consider extending benefits to allow for additional time for your employees to find their dream home. Multiple bids are common, and your employees may end up submitting offers on several properties before one is accepted. For high-cost areas, a Mortgage Payment Differential program helps ease the transferee into a higher payment by using a pre-determined benefit to supplement the mortgage payment for a period of time.

Whatever the financing needs of your transferees may be, SIRVA Mortgage is here to help. With 30 years of focus and expertise in relocation mortgage lending, we understand the important role home financing plays in the relocation process. Please visit our mortgage website to learn more, or contact us, at MortgageClientServices@sirva.com.

SIRVA Mortgage, Inc. (NMLS Unique Identifier# 2240) is engaged in the business of originating residential mortgage loans. We are licensed or authorized to conduct mortgage loan origination in all 50 states plus the District of Columbia. SIRVA Mortgage is not a depository institution and does not act as or represent itself a full-service bank. Reference to the term “mortgage banker” is a common, accepted industry term referring to companies engaged only in the business of making mortgage loans. Various state laws and regulations and our individual license in various states refer to us as a mortgage lender, mortgage banker or mortgage broker. For our Privacy Policy and Affiliated business relationships please visit https://mortgage.sirva.com/about/about-sirva-mortgage. Call 800-531-3837 for more information. SIRVA Mortgage, Inc. is licensed by (among others): Arizona Licensed Mortgage Banker, License #BK-901430; Licensed by the Department Corporations under the California Residential Mortgage Lending Act, Lender License #413-0944; Georgia Residential Mortgage Licensee #6221; Illinois Residential Mortgage Licensee; Kansas Licensed Mortgage Company, License # SL.0000368; Massachusetts Mortgage Lender, License #ML1341; Licensed by the Mississippi Department of Banking and Consumer Finance, Mississippi Licensed Mortgage Company #369/2009; Missouri Residential Mortgage Licensee; Montana Mortgage Lender License #39706, Licensed by the New Hampshire Banking Department; Licensed by the New Jersey Department of Banking and Insurance; New York Licensed Mortgage Banker by the N.Y. State Banking Department; Ohio Mortgage Broker License #MB.803887.000; Licensed by the Pennsylvania Department of Banking; Rhode Island Licensed Lender; Texas Mortgage Lender, License # 44605; Licensed as a Mortgage Lender by the Virginia State Corporation Commission, license #MC-310. This is not an offer of credit or an offer to enter an interest rate lock-in agreement nor is this notice of loan approval. Main Office of SIRVA Mortgage, Inc.; 6200 Oak Tree Blvd., Ste 300, Independence, OH 44131; Telephone: 1-800-531-3837.

Contributor: Cheryl Pfaffenberger, Director Client Services, SIRVA Mortgage