Resources

Understanding US Tax Liability Assistance for Transferees

Tax liability assistance, referred to as gross-up, is often the largest expense a company may incur, followed by home sale and household goods. Gross-up can best be described as an estimated tax reimbursement, paid by the employer on behalf of a transferee, to cover a transferee’s additional tax liability that has been incurred as a result of a relocation within the United States.

Because most relocation expenses need to be added to a transferee’s reported income and are subject to tax withholdings, a transferee’s tax liability could increase if the organisation is reimbursing or paying these costs on the transferee’s behalf. Gross-up helps offset this added tax liability. While there is no law requiring a company to provide a gross-up benefit to transferring associates, almost all of SIRVA’s clients include tax liability assistance in their relocation policies. Assistance may be calculated by the company or through the selected relocation management company (RMC). The amount of tax gross-up will be remitted by the business, directly to the appropriate revenue agency and reported as withheld taxes on the employee’s W-2 (Wage and Tax Statement).

Once a company determines the expenses upon which to provide tax assistance, a decision must be made about how the company is going to gross-up the expense: just once or multiple iterations, commonly referred to as ‘tax-on-tax’. The tax-on-tax method is used most often, because when a company offers a gross-up benefit, the company is paying the tax obligation of the transferee and the payment of the tax itself creates additional taxable income, which is then subject to income tax.

Providing Gross-Up: In-House Versus Through an RMC

The table below highlights a number of factors to consider when selecting a supplier for outsourcing expense and gross-up policy development and administration.

Criteria for Electing an Expense and Gross-Up Policy Consultant

| ISSUES | QUESTIONS AND FACTORS FOR CONSIDERATION |

|

Determine the supplier’s |

|

|

Not all organisations approach gross-up in the same way. |

|

|

Successful expense administration/tax assistance is driven by the process and procedures that are |

|

|

Additional factors to consider: |

|

Determining who should analyse a company’s gross-up methodology is a very important decision. Whether a company maintains this function inside its organisation or decides to outsource it to a third party/RMC, it is important to recognise the complexity of gross-up and look for individuals or a provider with the experience and skills to present a strategic vision to the overall relocation methodology. Even if the technical skills reside in-house, these individuals may not always have the time and breadth of experience required to conduct a thorough review.

Methodologies for Tax-Assistance

|

Tax-Assistance (Gross-Up) Methodologies

The primary gross-up methods include the:

Supplemental Method:

The most commonly used approach, companies that use the supplemental method calculate the transferee’s total tax due by using the IRS’s Supplemental Rate Table. This option does not take into account the phase out of deductions, exemptions and child credits.

Marginal Method:

Companies that use the marginal method calculate the transferee’s estimated taxable income before or after receiving the relocation expense reimbursement. The company then compares the estimated taxable income to the IRS Tax Tables. The tax table rate is then used to determine the tax assistance amount for that expense. The tax rate will not change for the expense and therefore is not blended.

Statute or Tax-Return Method:

Companies that use the statute or tax-return method calculate what a transferee’s tax return would be both before and after receiving the expense reimbursement. The difference between the two calculations is the gross-up amount. This method will result in a blended tax rate and takes into account the phase out of deductions, exemptions and child credits.

Flat-Rate Method:

Companies that use the flat-rate method determine a fixed percentage to be used in the tax-assistance calculation. This option does not take deductions, exemptions or child credits into account.

Gross-Up Approaches Used by SIRVA Clients

When choosing a methodology, decision makers should consider the following:

- Annualising salaries

- Tax-on-tax gross-up

- Employee’s filing status

- Handling of social security withholdings

- Local tax liabilities

- Which tax authorities should be included in the gross-up calculation

- Bonuses, incentives, and other income to be included

- Income that exceeds the transferring associate’s salary (e.g. spouse’s income)

- Whether a transferring employee itemises or uses the standard deduction

Which benefits are typically grossed-up?

Most relocation benefits are typically grossed-up unless they are tax excludable/non reportable (e.g. home sale through an RMC, the no-closing-cost loan through SIRVA, SIRVA Mortgage or tax deductible, some duplicate housing expenses).

The following relocation benefits may or may not be grossed-up, depending on the company’s preference. Per policy database statistics, SIRVA clients have been demonstrating the following trends as of 2021:

Typically Grossed-Up

- Loss-on-Sale Assistance: 91% gross-up this expense.

- Miscellaneous Pocket money: 61% gross-up this expense. In the past, a majority of organisations did not gross-up this expense, although it was found that employees often noted the amount that would be provided in their policy and did not realise that tax would be taken out. Many of these individuals became frustrated when the amount they actually received was lower than anticipated. As a result, tax assistance is now most commonly provided.

- Lump Sum Allowances:

- If the lump sum is within a relocation policy, 85% gross-up this expense.

- If the lump sum is intended to assist with all relocation expenses, 86% gross-up this expense.

Typically Not Grossed-Up

- High-Cost-Area Assistance (cost of living allowances, housing allowances, etc.): 83% do not gross-up this expense.

- Home-Sale Incentive/Bonus: 96% do not gross-up this expense.

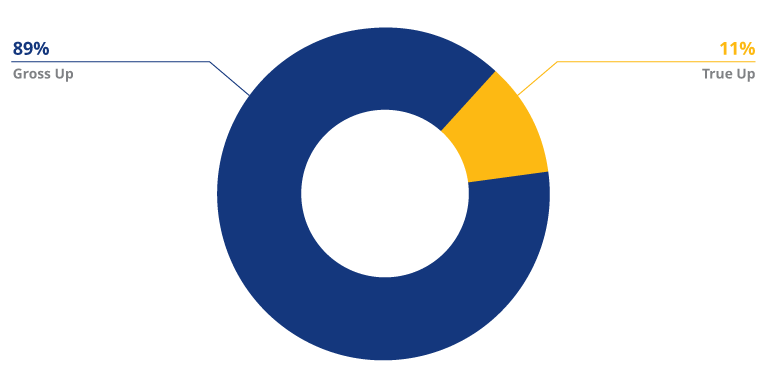

True-ups

Year-end ‘true-ups’ are relocation tax adjustments made at the end of a company’s tax year. These adjustments are the differences between the tax that was withheld throughout the year and what tax should have been withheld based on any changes to salary, FICA wages, filing status, and the relocation as a whole.

Percentage of SIRVA Clients Performing Year-End True-up

Year-End Procedures

Planning for year-end payroll procedures and the creation of a year-end timeline should start relatively early in the year — no later than September. This allows a company sufficient time to allocate resources and communicate with transferring associates in a timely manner. This year-end timeline is built so that all parties are aware of the year-end cut-off, that they are given adequate time to review the gross-up policy established, and for the payroll information to be included within the current tax year. Some of the action items that should be considered and/or incorporated into the timeline include:

- Establishing the year-end expense cut-off date

- Understanding the impact of the year-end expense cut-off date

- Deciding when to disseminate information to transferring employees, relative to the year-end procedures that will describe the impact of the year-end expense cut-off

- Establishing when to send the list of transferring employees being serviced to payroll

- Ascertaining when payroll needs the true-up or final payroll numbers

- Determining when a reconciliation will be performed to ensure that all systems are in balance before the year closes out

- Deciding who will send out the year-end packet that summarises the tax year activity to transferring employees – and when

These action items will differ slightly when working with a relocation service provider. When establishing the timeline, it is important to consider the time constraints and demands that are affecting both the transferring employee and human resources and payroll departments. Human resources and the relocation service provider should work hand-in-hand with the payroll department to transmit all relative data and to service the collective client — the transferring employee.

These action items will differ slightly when working with a relocation service provider. When establishing the timeline, it is important to consider the time constraints and demands that are affecting both the transferring employee and human resources and payroll departments. Human resources and the relocation service provider should work hand-in-hand with the payroll department to transmit all relative data and to service the collective client — the transferring employee.

After payroll year-end, transferring employees should receive a Relocation Tax Report (RTR), which replaces IRS Form 4782 and shows a summary of the relocation expenditure for the tax year, along with other documentation that will aid the transferring employees and/or the employee’s tax preparers in filing tax returns.

Conclusion

In addition to regular reviews, there are one-time events that may dictate the need to re-evaluate a relocation benefit. For example, COVID-19 brought about the United States Government declaring a National Emergency, implementing the provisions of Section 139 of the Internal Revenue Tax Code. This section, relating to disaster relief payments, provides a range of non-taxable relief benefits for employees that employers should be aware of, including how employee relocation and relief benefits should be classified and taxed.

Evaluating the gross-up methodology annually is critical to the success of a company's relocation policy and recruiting results. There is no one correct gross-up methodology; however, there may be a more appropriate methodology for a particular company at a given point in time. A company needs to understand the intent of the relocation policy and then align the tax gross-up feature with the overall relocation policy.

SIRVA Relocation assists companies with tax gross-up enquiries through one or more of the following:

- Director, Global Account Management: The director can assist with gross-up recommendations or may advise the company that information can be obtained from other sources.

- Advisory Services: As part of this offering, SIRVA conducts best practices benchmarking to ensure that a client 's relocation policy is both ‘in-line’ with best practices and competitive with others.

- Finance Department: SIRVA Finance can assist a company in determining which method works best for the business and does not force an organisation into one generic gross-up formula or methodology. SIRVA's system is flexible enough to handle a client's preferred method without difficulty and provides our clients, transferees, and payroll departments with the proper reports on a timely basis.

- Relocation Consultants: SIRVA’s relocation consultants can assist transferees in understanding the expense policy, so that they know how, when, and where to seek reimbursement.

For more information regarding how SIRVA can help your organisation with gross-up practices, please contact us at concierge@sirva.com.

NOTE: Neither this article nor the positions or statements contained herein may be relied upon in any manner by any client or any other person or entity to assert a claim against SIRVA for misrepresentation. This article is for informational purposes only based upon SIRVA’s experience in the industry and does not represent tax or legal advice of SIRVA and may not be relied upon as such. SIRVA does not and has not made any representations or warranties as to the tax or legal matters surrounding the Tax Liability Assistance Programme and the services to be rendered thereunder and SIRVA shall not be held liable or responsible for any tax or legal liability of any employer or its relocated transferees. In addition, as the Programme elements change from client to client, the information herein may be subject to modification. Each client must make its own tax and legal determinations based upon their particular circumstances.

Contributors

- Kristy Marconett, Director, Relocation Tax Services

- Jill McDonald, Director, Global Advisory Services